Lutz Q4 2025 Lender Rate Survey: Local Bank Responses to the Fed’s Recent Rate Cut

Fall is here, and with it comes the final push of 2025—83 days left to lock in deals before the year closes. As investors, this is a prime time to capitalize on market shifts, especially with the Federal Reserve’s recent 0.25% rate cut influencing borrowing costs. At Lutz Sales + Investments, we work closely with local commercial banks for the majority of our financed deals, so we wanted to dig into how the rate cut is playing out on the ground.

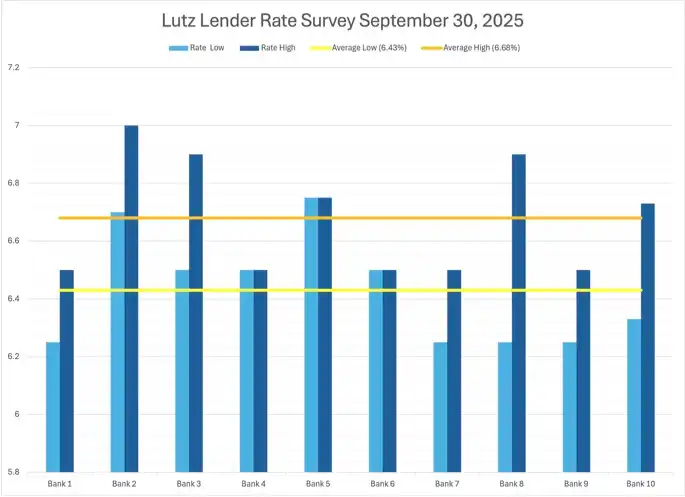

To get the full picture, we surveyed our go-to lenders as of September 30, 2025. The results? Local bank rates for multifamily and commercial real estate loans are holding in a competitive range of 6.25% to 7.00%. The average low rate across respondents came in at 6.43%, while the average high was slightly higher at 6.68%. This reflects a spread over the 5-year Treasury yield of 250 basis points (2.5%) on the low end and 325 basis points (3.25%) on the high end—solid margins that balance lender risk with borrower affordability in today’s lending market.

For context, the 5-year Treasury yield hovered around 3.93% at the end of September 2025, providing a benchmark for these spreads. This setup means well-qualified borrowers could secure rates on the lower side, especially for strong multifamily assets with proven cash flow.

Here’s a visual breakdown from our survey, showing low and high rates for each of the 10 participating banks:

Key Insights from the Survey:

- Amortization Terms: Most lenders stick to 25-year amortizations as their standard, but flexibility exists—30% of respondents offer up to 30 years for multifamily deals, while a few cap out at 20-year amortizations. Longer terms can ease monthly payments and improve debt service coverage ratios (DSCR), making deals more feasible in a higher-rate world.

- Lender Preferences: Only 20% of surveyed banks limit lending to Kansas City locals. Another 40% prefer in-area investors but are open to out-of-state buyers with strong profiles, and the remaining 40% welcome borrowers from out of the Kansas City area. This is great news for national investors eyeing KC’s multifamily market.

- Rate Cut Impact: The Fed’s move hasn’t triggered dramatic drops yet, but lenders noted it’s creating downward pressure. Expect rates to trend lower into Q4 if inflation continues cooling, potentially dipping below 6% for top-tier borrowers by year-end. Pair this with 100% bonus depreciation still available in 2025, and it’s a powerful combo for accelerating tax savings on new acquisitions.

Why This Matters for Investors

Lower rates mean improved cash-on-cash returns and easier qualification for larger loans. For example, on a $1 million multifamily purchase at 75 LTV with 6.43% and a 25-year amortization, your monthly principal and interest payment would be around $5,031 a noticeable improvement over mid-2024 peaks of 7.5% with a payment of $5,542. Factor in bonus depreciation via a cost segregation study, and you could front-load deductions to offset income now while enjoying higher cash flow.

If you’re modeling deals, remember to stress-test at higher rates (e.g., 7%) to ensure resilience. Tools like cap rate calculations (NOI / Purchase Price) and DSCR (NOI / Annual Debt Service) from our previous guides can help refine your analysis.

How are YOU planning to leverage falling rates and bonus depreciation this year? Whether it’s snagging one of these deals or refinancing existing holdings, the window is open.

Ready to Run the Numbers? At Lutz Sales + Investments, we’re investors first—so we get it. If you need help sourcing lenders, modeling scenarios, or evaluating these opportunities, reach out. Let’s make the most of Q4 together!