2025 Investor Guide to Kansas City Neighborhoods

Last updated: September, 2025

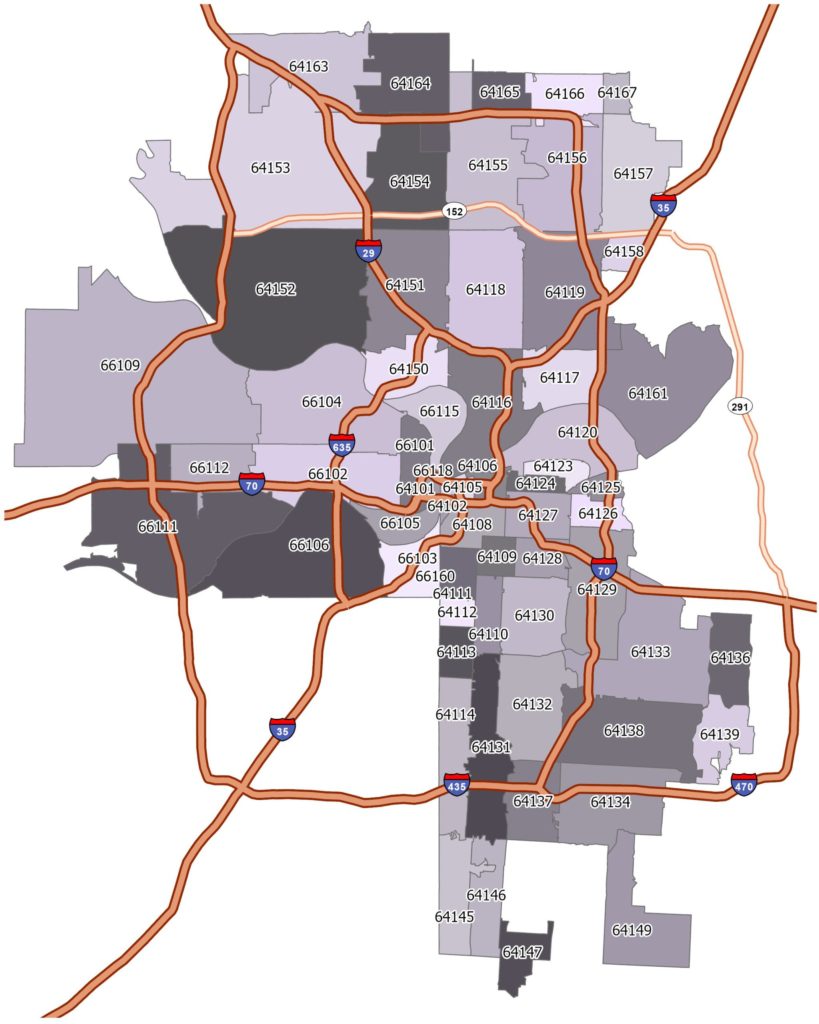

Kansas City is the “Heart of America” a transportation corridor in the middle of the country. The $9 B-plus downtown revival, Fortune-500 employers (Garmin, T-Mobile, H&R Block), and the brand-new single-terminal airport keep capital flowing into real estate. But not all ZIPs are created equal—so use this guide to match your investment thesis to the right neighborhoods and risk profile.

2025 Market Snapshot

| Metric | Latest reading | Source | |

| Median sale price (metro) | $255,000 | March 2025 | Realtor |

| Median 2-bed rent (KCMO) | $1,500 / mo | April 2025 | Zillow |

| Vacancy rate (Class A/B) | 6.4 % | Q1 2025 | berkadia.com |

| Metro population | 2.32 M | 2024 Census est. |

Historical Trends & Future Outlook

Over the past decade, Kansas City’s median home price has risen ~5 % annually, driven by job growth and affordable living. Looking ahead, the new KCI airport (opened 2023) and Meta’s $800 M data-center corridor in the Northland are set to boost property values significantly over the next five years, per local forecasts.

Missouri vs. Kansas Side—Quick Differences

- Schools: KS districts (Blue Valley, Shawnee Mission) score higher.

- Property taxes: Slightly higher in KS, but pockets of MO suburbs (Lee’s Summit, Blue Springs) are comparable.

- Housing stock: Kansas side skews 1960s-newer; Missouri side has the pre-war charm (usually without deferred capital expenses).

- Culture & density: Arts, nightlife, and high-density ZIPs cluster on KCMO’s south side; north of the river is bedroom-community terrain, also now hosts the $1.5 B KCI airport expansion and Meta’s data-center corridor.

Neighborhood Classes: Investor Lens

| Class | Tenants | Cash-flow | Appreciation | Example ZIPs |

| A/ B+ | Professional | Low | High | 64112, 64063, 66205 |

| B/ B- | Mix of professional & working | Moderate | Moderate | 64105, 64114, 66203 |

| C+/ C | Working class | High | Low | 64124, 64030, 66112 |

| D | Very low income | Erratic | Minimal | 64127, 66101 |

Top 25 ZIPs in Kansas City

| Zip Code | Region / Neighborhood | Grade |

| 64014 | Blue Springs | B+ |

| 64015 | Blue Springs | B+ |

| 66030 | Gardner | B+ |

| 64029 | Grain Valley | B+ |

| 64101 | Kansas City, MO | B+ |

| 64112 | Kansas City, MO | B+ |

| 64145 | Kansas City, MO | B+ |

| 64063 | Lee’s Summit | B+ |

| 64068 | Lee’s Summit | B+ |

| 64081 | Lee’s Summit | B+ |

| 64158 | Liberty | B+ |

| 64151 | Northland | B+ |

| 64152 | Northland | B+ |

| 64154 | Northland | B+ |

| 64155 | Northland | B+ |

| 66026 | Olathe | B+ |

| 66061 | Olathe | B+ |

| 66205 | Prairie Village | B+ |

| 64083 | Raymore | B+ |

| 66210 | Shawnee Mission | B+ |

| 66215 | Shawnee Mission | B+ |

| 66216 | Shawnee Mission | B+ |

| 66217 | Shawnee Mission | B+ |

| 66219 | Shawnee Mission | B+ |

| 64055 | Independence | B |

| 64056 | Independence | B |

| 64057 | Independence | B |

| 64105 | Kansas City, MO | B |

| 64108 | Kansas City, MO | B |

| 64110 | Kansas City, MO | B |

| 64111 | Kansas City, MO | B |

| 64114 | Kansas City, MO | B |

| 64131 | Kansas City, MO | B |

| 64137 | Kansas City, MO | B |

| 64138 | Kansas City, MO | B |

| 64119 | North Kansas City | B |

| 66202 | Overland Park / Merriam | B |

| 66203 | Overland Park / Merriam | B |

| 66204 | Overland Park / Merriam | B |

| 66212 | Overland Park / Merriam | B |

| 66214 | Overland Park / Merriam | B |

| 64012 | Belton | B-/C+ |

| 64030 | Grandview | B-/C+ |

| 64052 | Independence | B-/C+ |

| 64116 | North Kansas City | B-/C+ |

| 64117 | North Kansas City | B-/C+ |

| 64118 | Gladstone | B-/C+ |

| 64133 | Raytown | B-/C+ |

| 66106 | Kansas City, KS | B-/C+ |

| 66112 | Kansas City, KS | B-/C+ |

| 64050 | Independence | C |

| 64053 | Independence | C |

| 64054 | Independence | C |

| 64109 | Kansas City, MO | C |

| 64123 | Historic Northeast | C |

| 64124 | Historic Northeast | C |

| 64129 | Kansas City, MO | C |

| 64130 | Kansas City, MO | C |

| 64132 | Kansas City, MO | C |

| 64134 | Kansas City, MO | C |

| 64150 | Riverside | C |

| 66102 | Kansas City, KS | C |

| 66103 | Kansas City, KS | C |

| 66104 | Kansas City, KS | C |

| 66105 | Kansas City, KS | C |

| 64125 | Kansas City, MO | D |

| 64126 | Kansas City, MO | D |

| 64127 | Kansas City, MO | D |

| 64128 | Kansas City, MO | D |

| 66101 | Kansas City, KS | D |

Why Listen to Us?

Lee Ripma is a licensed multifamily broker in Kansas, Missouri, and California and the co-founder of VestMap, the mapping tool that helps investors pinpoint high-performing neighborhoods.

Since 2017 she has acquired 100 + rental units and advised on $350 million-plus in transactions across the Kansas City metro. Her data-first insights have been featured on BiggerPockets and Coach Carson.

Licenses & Memberships KS Broker #00246465 | MO Broker #2021021630 | CA DRE #02075167 | Member, Heartland MLS (HKMMLS)